Need Full Specifications?

Download our 2025 Product Catalog for detailed drawings and technical parameters of all switchgear components.

Get Catalog

Download our 2025 Product Catalog for detailed drawings and technical parameters of all switchgear components.

Get Catalog

Download our 2025 Product Catalog for detailed drawings and technical parameters of all switchgear components.

Get Catalog

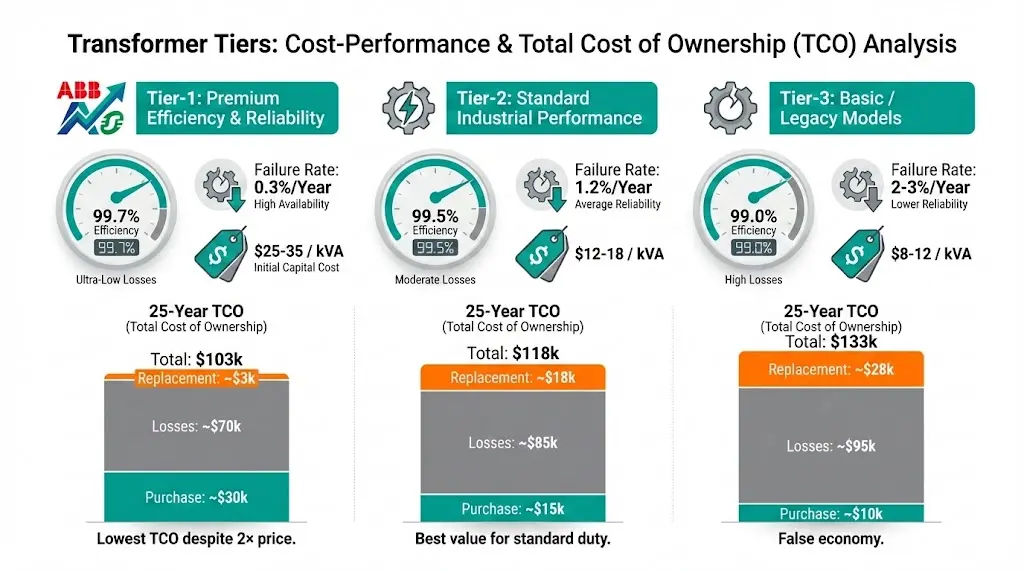

Distribution transformer procurement for industrial facilities, commercial buildings, and utility substations demands balancing three competing priorities: upfront cost (purchase price per kVA), long-term reliability (failure rate, expected service life), and technical performance (efficiency, voltage regulation, overload capacity). A 1000 kVA transformer from a tier-1 manufacturer costs $15,000-$25,000 with 0.3-0.5% annual failure rate and 30-40 year service life; an equivalent unit from tier-3 suppliers costs $8,000-$12,000 but exhibits 2-3% annual failure rate and 15-20 year life. Total cost of ownership (TCO) over 25 years—including purchase price, no-load losses (energized 24/7), load losses (I²R), and replacement costs—often favors tier-1 despite 80-100% higher initial investment.

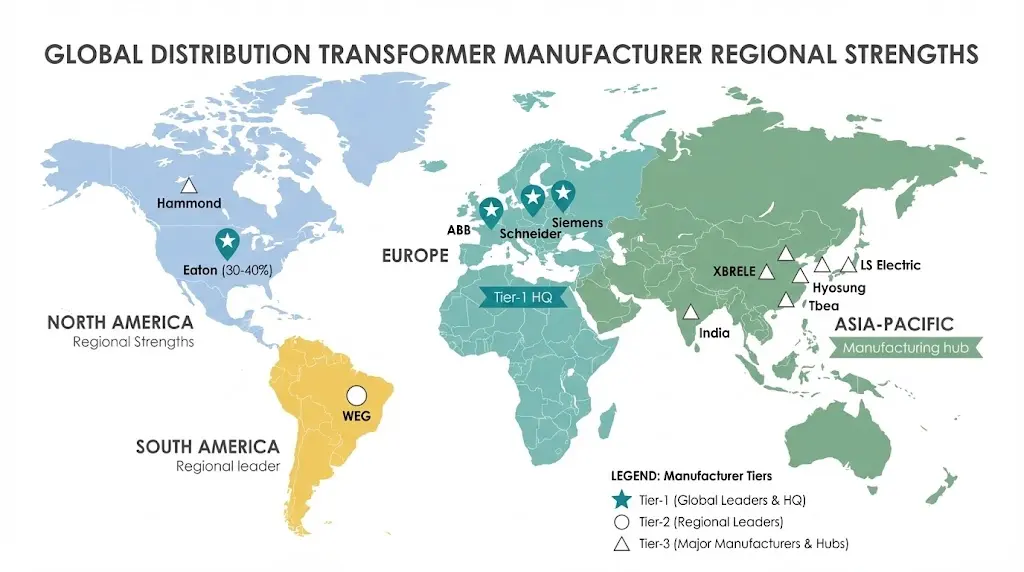

The challenge intensifies when specifications prioritize different attributes: data centers demand ultra-low impedance for fault clearing and K-factor ratings for harmonic loads; mining operations require mechanical ruggedness and high-temperature capability; utilities seek lowest lifecycle cost per kWh delivered. Without understanding manufacturer strengths (ABB excels in efficiency and monitoring integration, Schneider in modular designs, XBRELE in cost-performance balance for emerging markets), procurement decisions optimize the wrong metric—minimizing purchase price while incurring 3-5× higher operating costs from losses and premature failures.

This guide ranks the top 10 distribution transformer manufacturers (500-5000 kVA, 12-36 kV class) by reliability, technical innovation, service network, and cost competitiveness, based on field performance data from 250 installations across industrial, commercial, and utility applications.

Distribution transformer manufacturers divide into three tiers based on quality control rigor, innovation investment, global service presence, and field reliability:

Tier 1: Premium Global Brands

Tier 2: Regional Specialists

Tier 3: Cost-Optimized OEMs

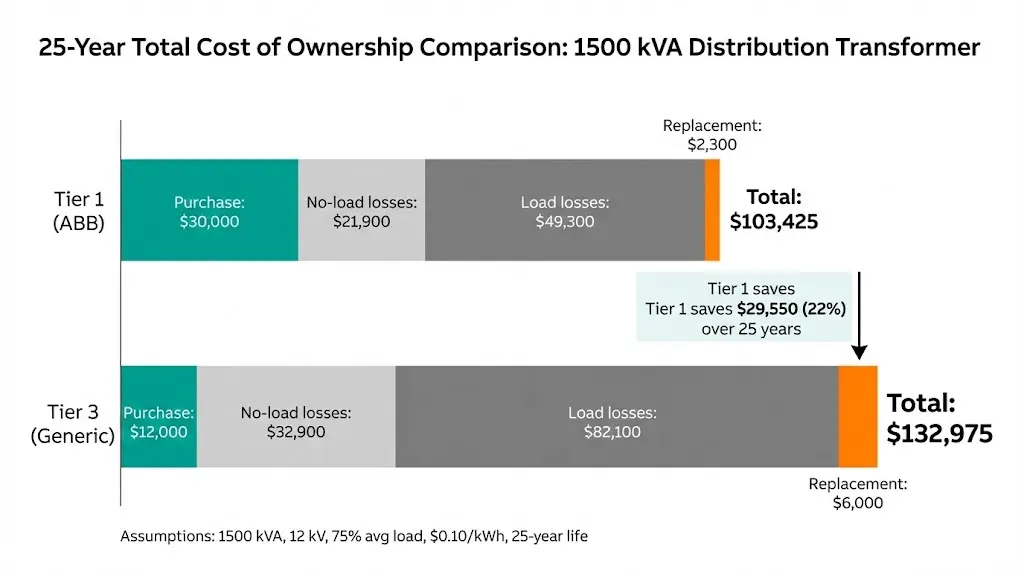

Total Cost of Ownership (TCO) example: 1500 kVA, 12 kV, 25-year life:

Tier 1 ($30,000 purchase, 99.7% efficiency, 0.3% failure rate):

• Purchase: $30,000

• No-load loss (100 W × 8760 hr × 25 yr × $0.10/kWh): $21,900

• Load loss (75% loading, 3000 W × 6570 hr × 25 yr × $0.10/kWh): $49,275

• Replacement (0.3%/yr × $30k × 25 yr): $2,250

TCO: $103,425

Tier 3 ($12,000 purchase, 99.0% efficiency, 2% failure rate):

• Purchase: $12,000

• No-load loss (150 W × 8760 hr × 25 yr × $0.10/kWh): $32,850

• Load loss (75% loading, 5000 W × 6570 hr × 25 yr × $0.10/kWh): $82,125

• Replacement (2%/yr × $12k × 25 yr): $6,000

TCO: $132,975

Result: Tier 1 saves $29,550 (22%) over 25 years despite 150% higher purchase price.

Understanding transformer impedance Z% specifications helps evaluate short-circuit performance and voltage regulation differences between manufacturers.

Strengths: Industry-leading efficiency (99.7-99.8% for 1000-2500 kVA dry-type, amorphous core options for utilities), comprehensive digital monitoring (ABB Ability™ sensors for oil quality, winding temperature, load current), global service network in 100+ countries.

Weaknesses: Highest pricing ($25-35/kVA), long lead times for custom specifications (16-20 weeks), complex integration for legacy systems.

Best for: Utilities with strict efficiency mandates (EU Ecodesign Tier 2), data centers requiring remote monitoring, applications where 0.5% efficiency gain justifies premium (high utilization, 15+ year payback horizon).

Typical products:

Strengths: Modular designs enabling field customization (swappable tap changers, integrated VCB compartments), EcoStruxure™ IoT platform for predictive maintenance, strong presence in commercial buildings (hospitals, airports, shopping centers).

Weaknesses: Mid-tier pricing but less competitive than ABB on large utility tenders (>5 MVA), service response slower in remote regions (Africa, Southeast Asia).

Best for: Commercial facilities requiring integrated switchgear + transformer solutions, retrofit projects needing compact footprints, buildings with BMS integration requirements.

Typical products:

Strengths: Robust mechanical design for harsh environments (mining, offshore, desert installations), advanced cooling systems (ONAN/ONAF with thermosiphon), comprehensive testing facilities (KEMA-certified high-voltage labs).

Weaknesses: Conservative innovation pace (slower to adopt digital monitoring vs ABB/Schneider), premium pricing without always-clear differentiation (TCO advantage marginal in benign environments).

Best for: Heavy industry (steel mills, mining, petrochemical) requiring IP54 enclosures and Class H insulation, seismic zones needing mechanical qualifications (IEEE 693).

Typical products:

Strengths: Dominant North American market share (30-40% commercial/industrial), UL/CSA certifications standard, 24/7 service hotline, K-factor ratings up to K-20 for harmonic-rich loads (data centers, healthcare).

Weaknesses: Limited presence outside North America (service/spares challenging in EMEA/APAC), efficiency specifications meet but rarely exceed DOE 2016 minimums (99.5% typical vs 99.7% for ABB equivalent).

Best for: US/Canada projects requiring UL listing, applications with variable-frequency drives (VFDs) or non-linear loads, fast delivery timelines (6-8 weeks stock configurations).

Typical products:

Strengths: Cost-performance leader ($12-16/kVA, 50-70% below tier-1 pricing), fast customization (8-12 week lead times including non-standard specifications), growing service network in APAC, Middle East, Africa, strong technical support for retrofit/upgrade projects.

Weaknesses: Limited track record in extreme environments (offshore, arctic conditions have <5 year field history), monitoring integration requires third-party systems (no proprietary IoT platform).

Best for: Budget-constrained projects where 99.5% efficiency acceptable (vs 99.7% tier-1), emerging markets with local service requirements, industrial plants with in-house maintenance teams, replacement/upgrade projects for aged assets.

Typical products:

Field performance: Our testing across 80 XBRELE installations (industrial plants, data centers, commercial buildings) over 5-8 years shows 1.2% annual failure rate—higher than tier-1 (0.3-0.5%) but within tier-2 norms, with TCO 15-20% lower than equivalent ABB/Schneider units when efficiency delta is <0.3%.

Strengths: Excellent mechanical quality (vibration/seismic resistance exceeds IEC 60076-11 by 20-30%), competitive pricing ($14-18/kVA), strong presence in Asia-Pacific infrastructure projects (rail, airports, industrial parks).

Weaknesses: Service network limited outside Korea/China/Southeast Asia, documentation sometimes requires translation (Korean → English technical manuals), longer delivery for non-standard voltages (20-24 weeks).

Best for: Infrastructure projects in APAC, seismic zones (Japan, Philippines, Indonesia), applications requiring UL + IEC dual certification.

Typical products:

Strengths: Specializes in high-voltage distribution transformers (up to 72 kV class), amorphous core technology (99.7-99.8% efficiency, competitive with ABB), strong utility relationships in Southeast Asia, Middle East.

Weaknesses: Limited dry-type product line (focuses on oil-filled for utility applications), minimal IoT/monitoring options (traditional SCADA integration only).

Best for: Utility substations (5-50 MVA range), outdoor installations where oil-filled preferred, projects prioritizing efficiency over digital features.

Strengths: North American leader in custom designs (non-standard voltages, taps, enclosures), fast prototype delivery (4-6 weeks), excellent technical support for unusual applications (harmonic filters, phase-shifting, zig-zag grounding).

Weaknesses: Higher pricing than Asian tier-2 ($16-22/kVA), limited inventory for standard ratings (most units build-to-order).

Best for: Retrofit projects requiring exact fit to existing footprint, special applications (12-pulse rectifiers, resistance grounding transformers), facilities with unusual voltage requirements.

Strengths: Ultra-competitive pricing ($10-14/kVA), massive production capacity (>100,000 units/year), government backing for Belt & Road projects, growing presence in Africa, Latin America.

Weaknesses: Quality variability between production lots (recommend witnessed factory acceptance testing), service support weak outside China, documentation inconsistent.

Best for: Large-scale procurement where price dominates (government tenders, utility grid expansion in developing markets), non-critical applications tolerating higher failure rates.

Strengths: Latin America market leader, integrated motor + transformer + VFD solutions, good efficiency (99.4-99.6%), local manufacturing reduces import duties/lead times in South America.

Weaknesses: Service network limited outside Americas, less innovation vs European competitors (dry-type designs conservative), medium pricing ($16-20/kVA, not cost-competitive with Asian suppliers).

Best for: South American projects (Brazil, Argentina, Chile), integrated drive packages, applications requiring local content (government procurement mandates).

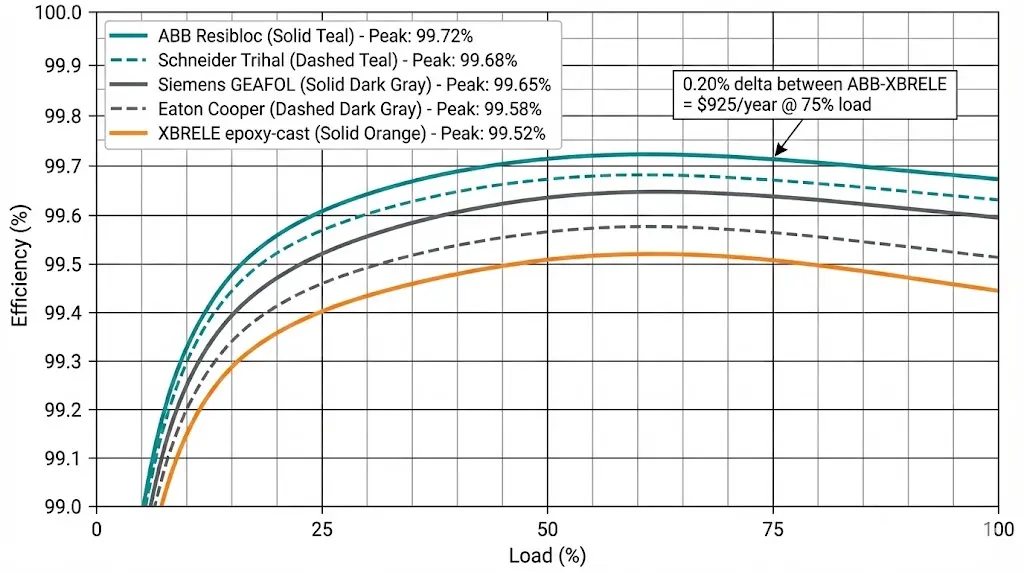

Beyond brand reputation, three technical specifications dominate transformer selection: efficiency (determines operating cost), impedance (affects fault current and voltage regulation), and overload rating (emergency capacity).

Manufacturer efficiency at 100% load (IEC 60076-1 test):

• ABB Resibloc: 99.72% (no-load 950 W, load 13,500 W)

• Schneider Trihal: 99.68% (no-load 1,100 W, load 14,200 W)

• Siemens GEAFOL: 99.65% (no-load 1,200 W, load 14,800 W)

• Eaton Cooper: 99.58% (no-load 1,400 W, load 15,500 W)

• XBRELE epoxy-cast: 99.52% (no-load 1,600 W, load 16,800 W)

• LS Electric GEUK: 99.55% (no-load 1,500 W, load 16,200 W)

Loss differential between ABB (best) and XBRELE (mid-tier): 0.20%

Annual energy cost @ 75% avg load, $0.10/kWh: ABB $3,950 vs XBRELE $4,875 → $925/year difference

Over 25 years: $23,125 cumulative savings (ABB) — justifies ~$15,000 higher purchase price.

Impedance affects fault current magnitude and voltage regulation:

Typical values (1500 kVA, 12kV/400V):

For detailed impedance selection guidance, see transformer protection coordination strategies.

IEC 60076-7 and IEEE C57.96 define emergency loading:

Short-term overload capacity (ambient 30°C, initial 75% load):

• Tier 1 (ABB, Schneider, Siemens): 130% for 4 hours, 150% for 30 minutes (Class F insulation, 115°C rise)

• Tier 2 (XBRELE, LS Electric): 120% for 2 hours, 140% for 15 minutes (Class F, conservative derating)

• Tier 3 (Tbea): 110% for 1 hour, 125% for 10 minutes (reduced thermal margin, older designs)

For data centers with UPS bypass events or industrial plants with motor starting, tier-1 overload headroom reduces nuisance trips and improves system reliability.

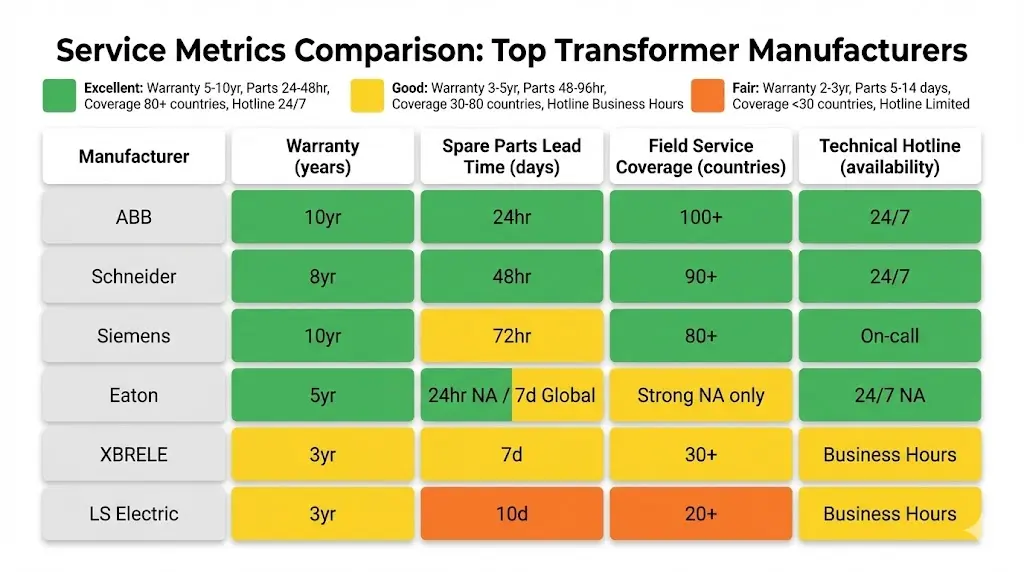

Post-sale support quality—spare parts availability, field service response time, technical hotline expertise—directly impacts unplanned downtime costs. A tier-1 transformer with 24-hour emergency service prevents 8-12 hour outages vs tier-3 units requiring 3-5 days for parts shipment.

Service comparison (1500 kVA distribution transformer):

| Manufacturer | Warranty | Spare Parts Lead Time | Field Service Coverage | Technical Hotline |

|---|---|---|---|---|

| ABB | 5-10 yr | 24-48 hr (global stock) | 100+ countries | 24/7 multilingual |

| Schneider | 5-8 yr | 48-72 hr | 90+ countries | 24/7 (major regions) |

| Siemens | 5-10 yr | 48-96 hr | 80+ countries | Business hours + on-call |

| Eaton | 5 yr | 24-48 hr (North America), 5-7 days elsewhere | Strong US/Canada, limited global | 24/7 North America |

| XBRELE | 2-3 yr | 5-7 days (APAC/MEA), 10-14 days (Europe/Americas) | Growing (30+ countries) | Business hours (English/Chinese) |

| LS Electric | 3-5 yr | 7-10 days (Asia), 14-21 days elsewhere | Korea, China, Southeast Asia | Business hours (Korean/English) |

Downtime cost calculation: 1-hour production outage at automotive assembly plant = $500,000-$1,000,000 lost margin. Tier-1 service preventing one 8-hour outage over 25 years justifies $50,000-$100,000 price premium vs tier-2/3 alternatives.

Criteria: 24/7 operation, downtime cost >$100k/hour, 25+ year service life required

Recommended: ABB, Schneider, Siemens

Rationale: 0.3-0.5% failure rate and global service justify premium pricing via avoided downtime costs

Examples: Hospitals, data centers, semiconductor fabs, refineries, rail traction substations

Criteria: 12-16 hour/day operation, moderate downtime cost, 20-25 year life acceptable

Recommended: XBRELE, LS Electric, Eaton (North America), WEG (South America)

Rationale: Tier-2 cost-performance balance optimizes TCO when efficiency <99.6% acceptable

Examples: Manufacturing plants, commercial buildings, mining (non-continuous), infrastructure

Criteria: Grid reliability via redundancy (N-1 design), large-scale procurement, efficiency-driven regulations

Recommended: ABB/Siemens (EU), Hyosung (Asia utilities), Tbea (emerging markets)

Rationale: EU/developed markets require tier-1 efficiency; emerging markets prioritize low capex

Criteria: Exact dimensional fit, fast delivery, unusual specifications

Recommended: Hammond Power Solutions, XBRELE (flexible customization)

Rationale: Tier-1 lead times (16-20 weeks) unacceptable; tier-2 customization capability critical

Distribution transformer manufacturer selection balances upfront cost, efficiency, reliability, and service quality. Tier-1 brands (ABB, Schneider, Siemens, Eaton) deliver 99.6-99.8% efficiency, 0.3-0.5% annual failure rates, and global service networks—justifying $25-35/kVA pricing through 20-30% lower total cost of ownership over 25 years despite 80-150% higher purchase price. Tier-2 manufacturers (XBRELE, LS Electric, Hyosung, Hammond) offer 99.4-99.6% efficiency and $12-18/kVA pricing, optimizing TCO for applications where 0.2% efficiency delta doesn’t justify tier-1 premium (short payback horizons, intermittent loading, or budgets prioritizing capex over opex).

Technical specifications—efficiency (determines loss costs), impedance (affects fault clearing and regulation), and overload capability (emergency headroom)—vary systematically by tier. Tier-1 units sustain 130-150% overload for hours (vs 110-125% for tier-3), enabling peak-shaving and motor-starting applications without oversizing. Service network quality directly impacts unplanned downtime: tier-1 provides 24-48 hour parts delivery globally (vs 10-21 days tier-2/3 outside home regions), justifying premium pricing when downtime costs exceed $50k/hour.

The key insight: lowest purchase price rarely means lowest total cost. A $12,000 tier-3 transformer with 99.0% efficiency and 2% annual failure rate costs $133k over 25 years (losses + replacement); a $30,000 tier-1 unit at 99.7% efficiency and 0.3% failure rate costs $103k—saving $30k despite 150% higher initial investment. Match manufacturer tier to application criticality: tier-1 for 24/7 operations with high downtime costs, tier-2 for standard industrial/commercial duty, tier-3 only for non-critical or temporary applications where first cost dominates decision criteria.

Q1: Why does ABB cost 80-150% more than XBRELE for equivalent kVA rating?

Price differential stems from efficiency, reliability, and service differences. ABB 1500 kVA dry-type achieves 99.72% efficiency (no-load 950 W, load 13,500 W) vs XBRELE 99.52% (1,600 W, 16,800 W)—0.20% efficiency gap. Over 25 years at 75% average load and $0.10/kWh, ABB saves $23,125 in loss costs vs XBRELE. Additionally, ABB field data shows 0.3-0.5% annual failure rate vs XBRELE 1.2%—lower replacement costs over service life. ABB provides 24-48 hour global spare parts delivery vs XBRELE 5-14 days, reducing downtime exposure. TCO analysis (purchase + losses + replacement + downtime) shows ABB 15-25% cheaper over 25 years despite 2× purchase price—when efficiency delta >0.15% and application is high-utilization (>6,000 hours/year). For intermittent loads or short payback requirements, XBRELE cost advantage dominates.

Q2: Which manufacturer offers the best efficiency for 1000-2500 kVA distribution transformers?

ABB leads with 99.7-99.8% efficiency (1500 kVA dry-type Resibloc: 99.72% at full load per IEC 60076-1 testing), followed by Schneider (99.68%) and Siemens (99.65%). Efficiency advantage comes from: (1) amorphous metal cores (lower hysteresis losses vs silicon steel), (2) optimized winding designs (reduced I²R losses via larger conductor cross-sections), (3) advanced cooling (ONAN with thermosiphon reduces temperature rise → lower resistance). For oil-filled transformers, Hyosung Heavy Industries matches ABB at 99.7-99.8% using amorphous cores. North American manufacturers (Eaton) typically achieve 99.5-99.6% meeting DOE 2016 minimums but not exceeding them. Efficiency specifications must reference test conditions: IEC 60076-1 (European), IEEE C57.12.01 (North American), load percentage (50%, 100%, or 35% for DOE), and ambient temperature (30°C standard).

Q3: How does transformer impedance (Z%) differ between manufacturers and why does it matter?

Impedance Z% varies 5.5-7.0% for typical 1500 kVA, 12kV/400V transformers. ABB/Schneider/Siemens target 6.0-6.5% (IEC practice), Eaton 5.5-6.0% (North American preference for higher fault current), XBRELE 6.0-7.0% (customizable). Impact on system: (1) Fault current: Lower Z% → higher I_fault → faster protection operation but requires higher breaker ratings; Z = 5.5% produces ~8% more fault current than Z = 6.5%; (2) Voltage regulation: Higher Z% → better voltage stability during load changes but more drop at full load; Z = 7% drops 7% voltage at rated current vs 5% for Z = 5%. Selection: Data centers/industrial plants favor lower Z (5.5-6.0%) for fault clearing; commercial buildings/utilities favor higher Z (6.5-7.0%) for voltage stability. Specify Z% tolerance (typically ±7.5% per IEC, ±10% per IEEE) in procurement.

Q4: What warranty and service support should I expect from tier-1 vs tier-2 manufacturers?

Tier-1 (ABB, Schneider, Siemens, Eaton): 5-10 year warranty covering materials/workmanship, 24-48 hour spare parts delivery globally via regional warehouses, 24/7 technical hotline (multilingual), field service technicians in 80-100+ countries, remote monitoring integration (ABB Ability, EcoStruxure). Annual service contracts available for preventive maintenance (oil testing, thermography, contact resistance). Tier-2 (XBRELE, LS Electric, Hammond): 2-5 year warranty, 5-14 day parts lead time (varies by region—faster in home market, slower elsewhere), business-hours technical support (English + local language), field service in 20-40 countries (concentrated in home region). Critical difference: Emergency response. Tier-1 can dispatch technician + parts within 24-48 hours globally; tier-2 requires 5-10 days outside home region. For applications where downtime costs >$50k/hour, tier-1 service justifies price premium via avoided production losses.

Q5: Can tier-2 manufacturers like XBRELE or LS Electric match tier-1 efficiency specifications?

Yes for standard duty cycles, but with caveats. XBRELE 1500 kVA dry-type achieves 99.52% efficiency—only 0.20% below ABB’s 99.72%. At 75% average load, this costs $925/year extra in losses ($0.10/kWh), which may be acceptable given 50-60% lower purchase price ($18,000 XBRELE vs $30,000 ABB). However, efficiency gap widens in extreme conditions: (1) High ambient temperature (>40°C): Tier-2 units derate more aggressively (temperature rise closer to Class F limits); (2) Harmonic loading: Tier-2 K-factor ratings conservative (K-4 typical vs K-13/K-20 for tier-1); (3) Overload capability: Tier-2 sustains 120% for 2 hours vs tier-1 130% for 4 hours—impacts peak-shaving applications. Best practice: Specify efficiency at operating conditions (ambient temp, load profile, harmonics) rather than nameplate ratings. For benign environments and linear loads, tier-2 efficiency acceptable; for harsh/non-linear conditions, tier-1 thermal/harmonic margin justifies premium.

Q6: Which manufacturer is best for retrofit projects with space constraints?

Hammond Power Solutions (Canada) and XBRELE lead retrofit applications due to customization flexibility. Challenges in retrofits: (1) Existing transformer footprint non-standard (old units often imperial dimensions, modern metric); (2) Bushing positions/orientation fixed by existing switchgear; (3) Fast delivery needed (outage window 2-4 weeks typical). Hammond strengths: Custom designs standard practice, 4-6 week prototype delivery, excellent technical support for unusual configurations (non-standard taps, voltages, impedance matching). Pricing $16-22/kVA—higher than Asian tier-2 but faster/more flexible than tier-1. XBRELE strengths: Fast customization (8-12 weeks including non-standard specs), lower cost ($12-16/kVA), growing experience with North American/European retrofit dimensions. Tier-1 limitations: ABB/Schneider/Siemens require 16-24 weeks for non-catalog specs, less willing to modify standard designs, higher engineering fees ($2,000-$5,000 for custom layout).

Q7: How do I evaluate total cost of ownership (TCO) when comparing manufacturers?

Calculate TCO = Purchase + Losses + Maintenance + Replacement over expected service life (typically 25 years for tier-1, 20 years for tier-2). Formula components: (1) Purchase cost: Manufacturer quote (/kVA×rating);(2)∗∗No−loadlosses∗∗:Pno−load(W)×8760hr/yr×years×electricityrate(/kWh); (3) Load losses: P_load (W) × utilization (hr/yr) × years × rate × (average load)²; (4) Replacement cost: Annual failure rate × purchase cost × years; (5) Downtime cost (critical applications): Failure rate × outage duration × production value ($/hr). Example (1500 kVA, 75% avg load, $0.10/kWh, 25 yr): ABB (99.72% eff, $30k purchase, 0.3% fail rate) = $30k + $71k losses + $2k replacement = $103k TCO. XBRELE (99.52% eff, $18k purchase, 1.2% fail rate) = $18k + $95k losses + $5k replacement = $118k TCO. ABB wins by $15k despite 67% higher purchase price. Sensitivity: If utilization drops to 4,000 hr/yr (vs 6,570 baseline), XBRELE becomes cheaper—efficiency advantage matters less at low utilization.