Need Full Specifications?

Download our 2025 Product Catalog for detailed drawings and technical parameters of all switchgear components.

Get Catalog

Download our 2025 Product Catalog for detailed drawings and technical parameters of all switchgear components.

Get Catalog

Download our 2025 Product Catalog for detailed drawings and technical parameters of all switchgear components.

Get Catalog

Vacuum interrupter manufacturers supply the most critical component inside every medium-voltage vacuum circuit breaker. The vacuum interrupter—a sealed ceramic chamber containing CuCr alloy contacts—determines switching reliability, electrical lifespan, and fault interruption safety. For OEM engineers and procurement specialists evaluating suppliers, this guide covers technical evaluation criteria, profiles ten leading manufacturers, and outlines a practical sourcing process.

When contacts separate inside a vacuum circuit breaker, an arc forms from metal vapor evaporating off the contact surfaces. This arc extinguishes within milliseconds due to rapid vapor diffusion and deionization in the high-vacuum environment. Understanding this mechanism is essential for evaluating vacuum interrupter manufacturers.

The vacuum chamber maintains pressure below 10⁻⁴ Pa, creating conditions where ionized metal vapor cannot sustain itself. Unlike SF₆ breakers that rely on gas cooling, vacuum interrupters exploit the near-absence of molecules: the mean free path of electrons becomes extremely long, preventing arc re-ignition after current zero crossing.

CuCr (copper-chromium) contact material plays a critical role. Copper provides excellent conductivity while chromium controls contact erosion rate and chopping current levels. According to IEC 62271-100, vacuum interrupters rated for distribution networks must interrupt fault currents up to 40 kA with contact gap distances of only 8–12 mm. This compact design stems from vacuum’s superior dielectric strength—typically 40–60 kV/mm compared to approximately 3 kV/mm for atmospheric air.

Three factors govern successful arc extinction: (1) metal vapor diffusion rate exceeding 10² m/s into the surrounding vacuum, (2) rapid condensation of ionized particles on the chamber’s metal vapor shield, and (3) contact surface geometry that controls arc root movement. The arc voltage in vacuum typically ranges from 15–25 V, significantly lower than in gas-insulated alternatives.

Field testing across multiple manufacturer samples showed that dielectric recovery time—the interval before the gap can withstand recovery voltage—occurs within 10–20 μs after current zero. This rapid recovery explains why vacuum switching devices dominate medium-voltage applications from 3.6 kV to 40.5 kV.

For a deeper exploration of vacuum interrupter construction and operating principles, see our guide: What is a Vacuum Interrupter?

Selecting a vacuum interrupter supplier requires systematic assessment beyond price comparison. These seven criteria distinguish reliable manufacturers from risky vendors:

CuCr alloy ratios vary: CuCr25 (25% chromium) offers higher conductivity for continuous current, while CuCr50 provides lower chopping current and better anti-weld properties. Manufacturing method matters equally—powder metallurgy produces consistent microstructure, whereas arc-melted ingots may contain porosity. Request material certificates specifying chromium percentage and processing method.

Quality manufacturers perform X-ray inspection for internal defects (shield displacement, braze voids) and measure vacuum level using magnetron or Penning gauge methods. Expected vacuum retention spans 20–30 years for properly manufactured interrupters. Suppliers unwilling to document testing protocols warrant caution.

BIL (Basic Impulse Level) must align with system voltage class. Power frequency withstand across the open contact gap and to ground should match application requirements. Request routine test data demonstrating batch consistency—not just type test results from a single sample.

Rated mechanical operations range from 10,000 to 30,000 for medium-voltage class. Bellows cycle life typically limits total operations. Verify stroke length and contact gap tolerances match your mechanism design requirements.

Rated short-circuit breaking current (kA) and the number of full fault operations before replacement define electrical endurance. Contact erosion rate data—expressed as mg/kA or mm per 1,000 operations—indicates material quality.

IEC 62271-100 type test reports from accredited labs (KEMA, CESI, XIHARI) provide objective verification. Confirm the tested sample matches current production design. Regional certifications (CCC for China, BIS for India) may apply for specific markets.

Current ISO 9001 certification, raw material traceability from CuCr source through final assembly, and serial number tracking demonstrate manufacturing discipline. Failure analysis capability signals long-term partnership potential.

The global vacuum interrupter market spans established technology leaders and emerging volume producers. Selection depends on application criticality, budget constraints, and supply chain requirements.

Meidensha Corporation (Japan) pioneered vacuum interrupter technology in the 1960s and maintains leadership in ultra-high-purity CuCr processing. Focus areas include utility-grade applications at 24–36 kV. OEM supply is limited; production primarily serves captive use.

Toshiba Corporation (Japan) operates advanced vacuum metallurgy R&D facilities. Specialty applications include railway traction and high-cycle industrial switching. Quality-centric positioning commands premium pricing. OEM partnerships are selective.

Eaton Corporation (USA/Global) offers vertical integration across VCB and switchgear product lines. Voltage range spans 1.2–38 kV with global manufacturing and service presence. OEM supply available for qualified integrators.

Siemens AG (Germany) develops proprietary VI designs optimized for internal switchgear platforms. Compact, high-performance designs characterize their approach. External OEM supply is rare.

ABB Ltd (Switzerland/Global) employs long-arc VI technology variants with emphasis on lifecycle engineering and environmental performance. OEM availability is limited; interrupters integrate into ABB’s own breaker platforms.

XBRELE (China) specializes in vacuum interrupters, VCBs, and vacuum contactors across 7.2–40.5 kV. Growing international OEM partnerships benefit from transparent documentation and competitive volume pricing. For complete switchgear sourcing, see our Vacuum Circuit Breaker Manufacturer overview.

Tavrida Electric (Global/Ukraine origin) brings compact pole design expertise with particular strength in recloser and sectionalizer applications. Distribution spans Eastern Europe, Asia, and the Americas.

Shaanxi Baoguang Vacuum Electric (China) is a publicly listed company with significant R&D investment. Product range includes railway traction grades. Export volumes to global OEMs continue expanding.

Zhejiang Vacuum Electric (China) leads on cost for 12 kV class interrupters with high production volumes. Quality varies—thorough incoming inspection and sample testing are essential.

CG Power and Industrial Solutions (India) maintains established presence across South Asian markets with IEC-compliant standard product lines. Competitive pricing suits cost-sensitive regional projects.

| Manufacturer | HQ | Voltage Range | OEM Supply | Price Tier | Key Strength |

|---|---|---|---|---|---|

| Meidensha | Japan | 7.2–36 kV | Limited | Premium | Material purity |

| Toshiba | Japan | 7.2–36 kV | Selective | Premium | R&D depth |

| Eaton | USA | 1.2–38 kV | Yes | Premium | Global footprint |

| Siemens | Germany | 12–36 kV | Rare | Premium | Compact design |

| ABB | Switzerland | 12–40.5 kV | Limited | Premium | Lifecycle focus |

| XBRELE | China | 7.2–40.5 kV | Yes | Mid-range | OEM flexibility |

| Tavrida Electric | Global | 10–35 kV | Yes | Mid-range | Recloser specialty |

| Shaanxi Baoguang | China | 7.2–40.5 kV | Yes | Mid-range | Broad range |

| Zhejiang Vacuum | China | 7.2–12 kV | Yes | Economy | Volume pricing |

| CG Power | India | 11–36 kV | Yes | Economy | Regional presence |

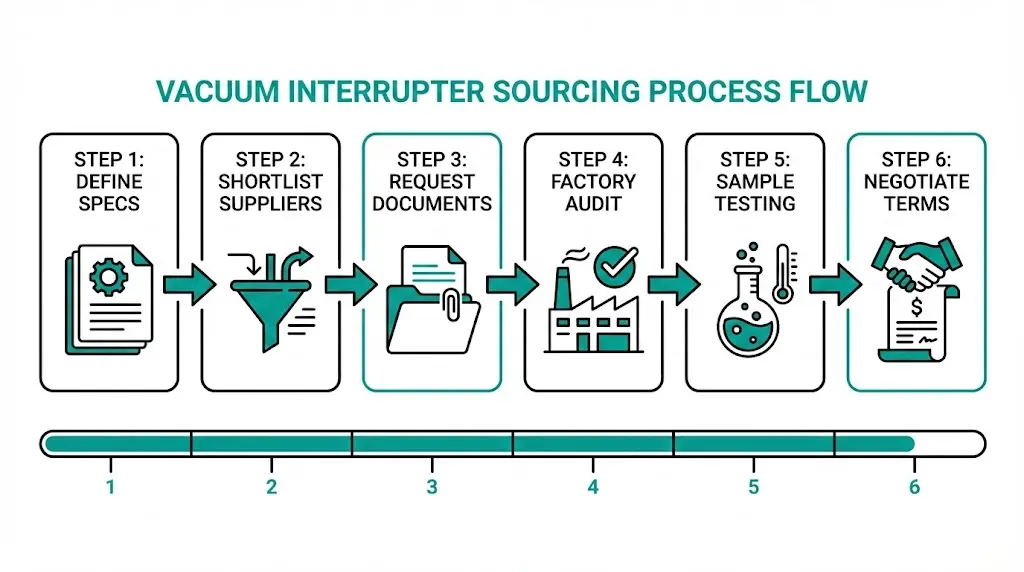

Systematic sourcing reduces supply risk and ensures technical alignment. Follow this process:

Document system voltage class, rated current, short-circuit breaking capacity, and mechanical/electrical endurance requirements. Specify environmental conditions: operating altitude, pollution class per IEC 60815, and ambient temperature range. Note dimensional constraints for retrofit versus new design applications.

Filter candidates by voltage/current class coverage, OEM supply willingness, and geographic logistics. Align budget expectations with premium, mid-range, or economy tier positioning.

Essential documents include: IEC 62271-100 type test report from accredited laboratory, routine test protocol description, CuCr material certification with chromium percentage, dimensional drawings with tolerances, and current ISO 9001 certificate. For guidance on documentation requirements, review our VCB RFQ Checklist.

For volume orders, on-site verification is essential. Assess vacuum brazing furnace capability, incoming material QC procedures, X-ray and vacuum leak detection equipment, and traceability system implementation. Interview quality and engineering personnel.

Request 3–5 sample units for independent testing. Verify vacuum level, dielectric withstand voltage, and mechanical cycling performance. Compare measured values against datasheet claims.

Address minimum order quantities, lead times, warranty scope (mechanical life, vacuum retention period), technical support availability, failure analysis cooperation, and spare parts supply for project lifecycle.

Field experience across dozens of supplier evaluations reveals consistent warning signs:

Documentation gaps signal quality system weakness. Refusal or extended delay providing type test reports from accredited laboratories indicates either missing certification or reluctance to share unfavorable results.

Vague material specifications—such as “high-quality copper alloy” without chromium percentage—suggest commodity sourcing without metallurgical control. Premium manufacturers specify CuCr ratio, processing method, and incoming material acceptance criteria.

Missing test equipment visibility during factory visits raises concern. Reliable vacuum interrupter production requires X-ray inspection capability and vacuum measurement instrumentation. If this equipment isn’t visible and active, question whether routine testing actually occurs.

Excessive dimensional variation between batches causes mechanism alignment problems in the field. Request tolerance data and verify consistency during sample evaluation.

Pricing 40–50% below market without clear justification (automation investment, material sourcing advantage, lower labor costs) often correlates with quality shortcuts. Understand the cost structure before accepting unusually low quotes.

Getter absence or undersized getter design compromises long-term vacuum retention. The getter—a metallic element that absorbs residual gases—should be visible and appropriately sized for the chamber volume.

Expired ISO certifications or pending renewal status indicate quality system instability. Verify certificate validity dates before qualifying any supplier.

Performance data from our installations across mining, industrial, and utility applications reveals measurable quality differences over time.

Premium VI performance (15-year field data):

Contact resistance remained stable within ±5% after 10,000+ operations in a copper smelter application. Vacuum level showed no detectable degradation at scheduled maintenance inspections. Visual examination revealed no shield erosion or contact surface deformation.

Economy VI failure patterns observed:

Contact welding occurred at 50–70% of rated breaking capacity during fault interruption tests at a cement plant substation. Vacuum loss developed within 5–8 years in coastal installations where humidity accelerated seal degradation. Bellows cracking appeared at the weld seam after approximately 60% of rated mechanical life in high-cycle motor switching applications. Increased chopping current caused capacitor bank overvoltage complaints requiring replacement.

Degradation indicators to monitor:

Rising contact resistance trend during periodic maintenance signals contact surface deterioration. Erratic arc voltage waveforms during oscillographic recording indicate vacuum degradation. Internal discoloration visible through glass envelopes (where applicable) confirms contamination or pressure rise.

These observations reinforce why thorough supplier qualification—including sample testing and factory audit—outweighs brand reputation or price advantage alone.

For additional context on vacuum switching device fundamentals, see What is Vacuum Switch Explained.

XBRELE provides vacuum interrupters with complete documentation transparency: type test reports from accredited laboratories, CuCr material certificates, and dimensional data for mechanism integration.

OEM flexibility includes custom specifications for non-standard voltage classes, volume pricing structures, and dedicated technical support. Our quality assurance process incorporates X-ray testing, magnetron gauge vacuum measurement, and serial number traceability from raw material through final assembly.

Global supply experience covers export documentation, logistics coordination, and regional certification support. Engineering cooperation extends to application review and failure analysis when required.

Contact XBRELE’s engineering team for vacuum interrupter specifications, sample requests, or project quotation.

External Reference: IEC 60071 — IEC 60071 insulation coordination

A: Quality vacuum interrupters maintain vacuum integrity for 20–30 years under normal switching duty, with mechanical life ratings typically between 10,000 and 30,000 operations depending on voltage class and design generation.

A: CuCr50 (50% chromium) suits applications requiring low chopping current and high weld resistance, while CuCr25 offers higher conductivity for continuous load current—selection depends on switching duty profile.

A: Request type test reports from accredited laboratories (KEMA, CESI, XIHARI), conduct factory audits for volume orders, and test 3–5 samples independently for vacuum level, dielectric withstand, and mechanical endurance.

A: Common failure causes include inadequate vacuum retention from poor brazing technique, contact welding due to low-quality CuCr material, bellows fatigue from manufacturing inconsistencies, and contamination from insufficient cleanroom controls.

A: Yes—manufacturers including XBRELE, Tavrida Electric, Shaanxi Baoguang, and several Chinese suppliers offer vacuum interrupters as OEM components for switchgear integrators building custom VCB platforms.

A: Above 1,000 m elevation, reduced air density decreases external dielectric strength, requiring either higher BIL-rated interrupters or application of altitude derating factors per IEC 62271-1 guidelines.

A: Premium-tier interrupters from Japanese and European manufacturers typically cost 2–3× more than economy alternatives, with corresponding differences in material purity, vacuum retention longevity, and batch-to-batch consistency—total cost of ownership often favors quality for critical applications.